For Sellers

You will realise by now that there is more to selling a business than the valuation, marketing and transaction. You will need to consider:

How to Maximise The Value

of Your Business

Your business is valued £x now, but how much could it be worth after

a period of business grooming?

Our advisors offer a consultancy service providing practical steps to transform your business from a lifestyle into an investment or perhaps re-orienting your business to attract buyers in a certain target market and thereby maximise the value you achieve from the sale.

Financial Due Diligence

You have just agreed a deal and signed a Heads of Terms agreement; now you receive a due diligence questionnaire from the buyer’s accountant asking for management accounts, VAT returns, tax returns, articles of association, cash-flow statements and a lot more. Are you and/or is your accountant prepared? Are there any hidden issues that will affect the sale? Delays in providing such information raise doubts with the buyer and provide excuses for the buyer to renegotiate or pull-out.

Our selected associates are qualified and experienced accountants and offer a pre-due diligence package to enable you to respond to these enquiries quickly and to address any issues before you start spending on legal fees for the transaction. They are more than happy to work with your own accountant.

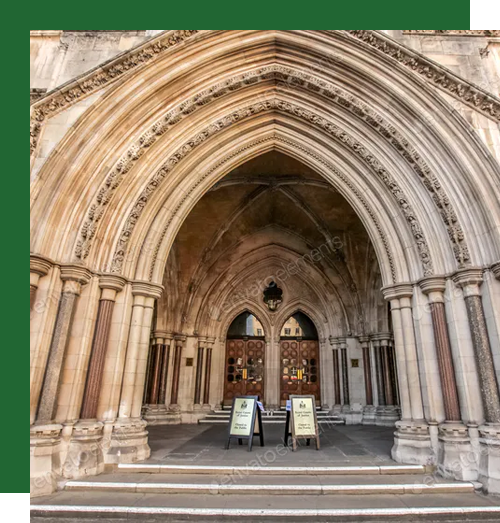

Legal Due Diligence

You have just agreed a deal and signed a Heads of Terms agreement; now you receive a due diligence questionnaire from the buyer’s legal representative asking for copies of employment contracts, client and supplier contracts, articles of association, shareholder agreements etc. Do you have this information to hand? Are there any hidden issues that will affect the sale? Employee liabilities and shareholder agreements are often areas for concern.

Our selected associates are experienced commercial lawyers and offer a pre-due diligence package to enable you to respond to these enquiries quickly and to address any issues before you put the business on the market.

Tax Planning

You have built your business over a period of years; it is a sound

investment that will attract good offers. How much of the sale

proceeds will you owe to HMRC? Advance tax planning is essential.

Our selected associates are able to advise you on the most appropriate business and deal structures to minimise your tax liability.

Personal Wealth Management

A key consideration in selling your business is how you will derive an income once you are no longer working in the business and drawing a salary. You may be approaching retirement; do you have sufficient provision for your pension? (This may be linked to the deal value you need to achieve from the sale of your business)

Alternatively, you have successfully sold your business and gained a substantial consideration. What will you do with the proceeds? How will you re-invest for the future?

Our selected associates are able to advise you on all aspects of wealth planning.

For Buyers

The acquisition is just the first step in a long term business and investment strategy. You will need to consider:

How to Finance an Acquisition

Do you require finance for your acquisition? Whether you proceed with our client’s business or another we have established links with banks and other lending institutions to whom we can introduce you.

Your Growth and Acquisition Strategy

You will need to consider carefully what is your growth and acquisition strategy? What are you looking for? For example: a client list, skilled staff, to expand into a new market.

Working with firms whose turnovers are typically over £3m, our

selected business consultants are able to assess your overall business strategy and ensure that your acquisition criteria is aligned.

Your Post-Acquisition Strategy

The acquisition itself is just the first step in a long term business and investment strategy. Integration of the new business is often not

considered fully until the transaction is completed – too late. The

goodwill of a business can easily be damaged if it is not managed well; therefore it is essential for businesses that buy another business to have a clear plan for the business post-acquisition.

Our selected business consultants offer clients the help and

information that is usually only available to the largest organisations. They help them identify synergies and ensure that the full benefit of the acquisition is realised by systematic post acquisition integration.

Direct to Your Inbox

Sign up to our monthly newsletter to receive listings of new businesses for sale.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact